The best camera insurance for photographers: cover your kit!

Your camera equipment deserves proper cover, but who provides the best camera insurance in 2025?

We all want the best camera – so surely we need the best camera insurance to go along with it. After all, we sink serious cash into our photographic kit, and if the worst happens and it gets lost, accidentally damaged, or even stolen, you want the proper protection in place.

Public liability insurance is also necessary for some photographers, covering you in the case of a member of the public (or client) getting injured or their property damaged as a result of your photography. This type of insurance is wise for wedding, portrait and event pros, or those running workshops in a public space.

Setting up a camera insurance policy is sensible if you're running a photography business, but really, it's a good idea for anyone who has invested money in the best cameras, lenses, lighting equipment and other pricey accessories.

Just think of all the camera accessories in your setup, from flashguns and tripods to microphones and ND filters… not to mention the glass! Telephoto lenses, portrait lenses, quirky Lensbaby lenses – you can easily end up with a collection of optics that are worth more than your actual camera.

And if you photograph weddings, shoot live music, or cover any other events where you'll be mixing with large groups of people, you may well find that your general household insurance might not cover these situations.

The best camera insurance in 2025

Why you can trust Digital Camera World

The question is, whatever the particular insurance premium may cost, is the alternative – no insurance – something that you can really afford?

We've looked at the insurance companies that specialise in dealing with photographers on a daily basis. Here are the candidates that provide the best camera insurance options for UK photographers in 2023…

1. Ripe photography insurance

Bespoke insurance for cameras, photographers and videographers

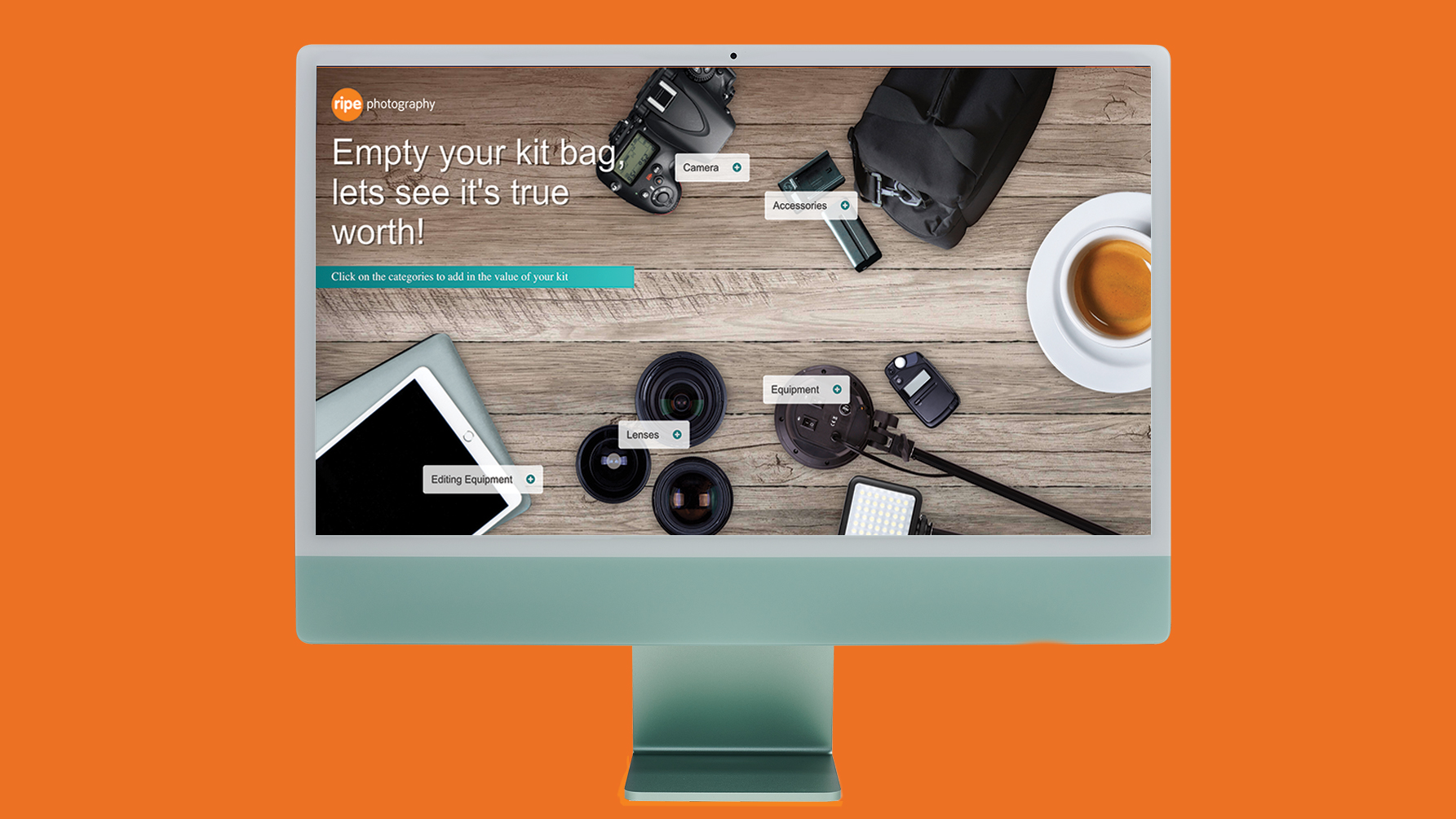

Ripe understands that no two photographers are the same – and neither are two bags of kit. That's why it offers bespoke camera insurance that features worldwide coverage for traveling, cover against theft from your home or an unattended vehicle, as well as accidental damage both at home and while away.

Beyond just cameras, though, Ripe also offers broader photography insurance, with equipment cover for lenses, stands, tripods, cases and other accessories, as well as coverage for portable and studio equipment, as well as offering Public Liability cover – and there's also an option to add cover for your phones and tablets if they're part of your photography workflow.

There's even dedicated consideration given to videographer insurance cover, too, so vloggers and cinematographers alike can tailor-make a policy to suit their specific needs. On top of all that, Ripe also has one of the most intuitive and helpful websites out there – including a special page that prompts you to double-check everything in your kit bag! Coverage starts from just £5.09 per month, and right now there's 20% off all policies.

2. Photoguard

£50 excess makes Photoguard stand out among rivals

Photoguard is a specialist when it comes to protecting your photographic equipment that might not otherwise be covered by your regular household insurance. It also makes the point that if you’re using the camera as a professional photographer, you may not be able to claim on your home insurance. A major advantage with Photoguard is that it has a claims excess of just £50 and can cover you for travel both in the UK and abroad.

Like others here, there are a couple of policies to choose from to speed up the application process, with the Select policy, covering a equipment to a maximum value of £25,000, and the Pro policy boosting this to £50,000 (and still with the same low £50 excess fee). The Pro policy also extends to covering 'associates' – which it classifies as fellow photographers or assistants who work with you – against claims by third parties. Potentially very useful, not to mention cost saving.

3. Towergate insurance (Camerasure)

All-risks cover for professional photographers and videographers

Of greater value perhaps to the all-jobbing professional than the strictly amateur – though it does offer a ‘semi pro’ option for enthusiasts – Towergate’s Camerasure insurance products are pitched primarily at freelance photographers and videographers, as well as those performing similar roles within multimedia institutions (translation: photo labs, picture libraries and media agencies).

Notably, as well as protecting your photographic equipment, it can also cover computer breakdown and data loss – equally crucial in this digital age – and any such damage/loss resulting in the need for a reshoot. If you’re travelling abroad for a shoot and can’t stash all your camera gear in your hand luggage, you'll be pleased to know it also covers damage to kit stored in the aircraft hold.

Cover also extends to potential legal liabilities to customers, employees and the general public, as one would expect of a pro policy. Another advantage is that Towergate Camerasure partners with a number of professional bodies – The RPS, for example – to give its members up to 40% discount off premiums, subject to certain criteria.

4. Aaduki multimedia insurance

Specialist insurance that includes equipment cover and liability insurances

As everyone’s requirements will be different, you may find a ‘tailor-made’ policy is best. Dealing with the photo trade for the past 12 years, and catering to both amateurs and professionals, that’s exactly what Aaduki offers, using a panel of insurers rather than just one.

This also means that the terms and conditions will vary from policy to policy and customer to customer; however, it also means that if one insurer is quoting too high for your liking, it can approach an alternative on your behalf who may be able to provide a more competitive premium or better terms.

In terms of coverage, peace of mind is offered by the fact Aaduki’s policies are universal ‘all risks’, meaning you’re covered fully for theft, accidental damage and accidental loss. If holidaying, customers can also include 60 days of worldwide cover or unlimited worldwide cover.

Instead of dealing with call centres abroad, customers can also source quotes direct from experts based in its UK office. Furthermore, members of the photography trade body, The Societies, get a discount.

5. Infocus photography insurance

Comprehensive insurance protection for photographers

Infocus offers insurance protection for both photographers and video makers, helping protect your business and enable it to quickly recover from any catastrophes. With its policies underwritten by Hiscox Insurance, there's the ability to pay in interest-free installments, while worldwide cover is also offered for photographic equipment. Interestingly, the company says it can also provide PR help if you ever need crisis containment.

To make sure applications are quick and easy, there are two levels of off-the-peg insurance policies offered to photographers and videographers, namely Basic and Standard. Priced at £199 and £299 per year respectively, they cover equipment to the value of £5,000 or £10,000, as required.

Both of these policies provide professional indemnity, which enables you to pay compensation to a third party who brings a claim for professional negligence, as well as public liability to cover you against injury or loss to third parties and their property, in addition to crisis containment insurance. Alternatively, you can create your own bespoke policy by using its website, or by calling its UK team direct to discuss.

5. Eversure Insurance

At the affordable end of the spectrum, with cover from just £19.99

Featuring theft and accidental damage as standard, Eversure's photography insurance is Feefo Platinum-rated and offers an impressive range of cover at a competitive price.

Underwritten by Ageas, this cover suits amateur and professional photographers alike, with accidental damage and theft cover as standard, and optional cover including up to £10 million worth of public liability, employer’s liability and worldwide cover. Eversure insurance will provide peace of mind to any photographer.

There's a range of cover levels, and it's easy to get a quote on the Eversure website. If your camera gear does get damaged or stolen, Eversure will pay out for its replacement or replace it with new kit at its original value when bought.

Based in Guildford, Surrey, Eversure says its team is on hand to answer queries during normal working hours, with policy amendments being able to be made either via phone or email.

6. PhotoShield

Photography and videography insurance for pros and semi-professionals

PhotoShield offers three standard tiers from £99 to £299, plus a Bespoke option, giving those who derive their income from photography some scalability in their coverage. Going Bespoke gives you the flexibility to accommodate non-standard cover, as well as options like employers' liability and studio/contents cover.

The £299 Option 3 comprises worldwide photographic equipment coverage of £10,000, worldwide laptop coverage of £1,500, static computers/equipment cover of £3,500, business interruption of £250,000, professional indemnity of £100,000, public liability of £2,000,000 and more.

Your kit is also covered in unattended vehicles (subject to being stored out of site) and in aircraft holds (provided it is stored in a Peli Case). PhotoShield replaces kit on a new-for-old basis across all its policies and is underwritten by Liverpool Victoria Insurance (LV=) in the UK, and Gable Insurance in Eire.

7. The Insurance Emporium

Tweakable insurance from £1.70 per month, with a 25% introductory discount

The Insurance Emporium has two comprehensive base policies, to which you can add elective benefits. Amateur and Semi-Professional policies are for photographers who earn less than 50% of their income from photography, with less than £25k of equipment; Professional policies are for those who earn more and own up to £50k of equipment.

Amateur & Semi-Professional policies include theft, loss or accidental damage, new for old, unattended vehicle, worldwide cover, replacement hire, data recovery, public liability and personal accident coverage. Professional policies also feature accidental portfolio damage, props, professional indemnity and business interruption.

The Insurance Emporium's elective benefits include the addition of gadgets and mobile phones, sports and action cameras, waterproof photographic equipment and other useful options.

Get the Digital Camera World Newsletter

The best camera deals, reviews, product advice, and unmissable photography news, direct to your inbox!

With over a decade of photographic experience, Louise arms Digital Camera World with a wealth of knowledge on photographic technique and know-how – something at which she is so adept that she's delivered workshops for the likes of ITV and Sue Ryder. Louise also brings years of experience as both a web and print journalist, having served as features editor for Practical Photography magazine and contributing photography tutorials and camera analysis to titles including Digital Camera Magazine and Digital Photographer. Louise currently shoots with the Fujifilm X-T200 and the Nikon D800, capturing self-portraits and still life images, and is DCW's ecommerce editor, meaning that she knows good camera, lens and laptop deals when she sees them.